The Pacific Prime Statements

The Pacific Prime Statements

Blog Article

The Buzz on Pacific Prime

Table of ContentsAll about Pacific PrimeNot known Factual Statements About Pacific Prime The Best Guide To Pacific PrimeA Biased View of Pacific PrimeAn Unbiased View of Pacific Prime

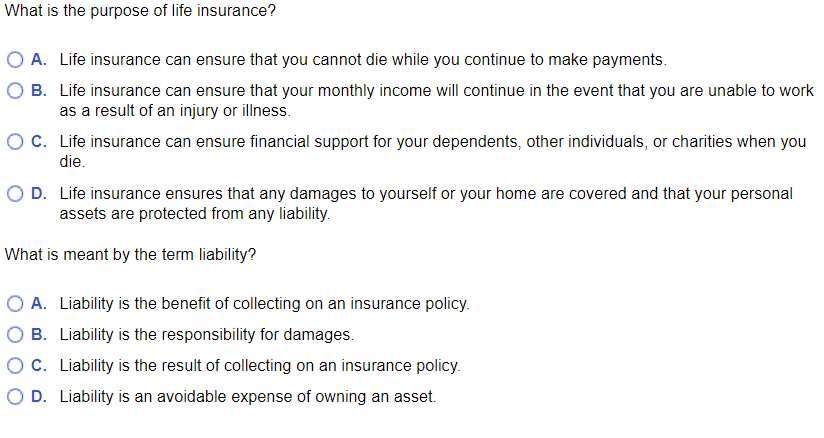

Insurance is a contract, stood for by a policy, in which a policyholder obtains monetary defense or reimbursement versus losses from an insurer. The firm swimming pools customers' threats to make settlements extra budget-friendly for the guaranteed. The majority of people have some insurance policy: for their auto, their residence, their healthcare, or their life.Insurance coverage additionally assists cover expenses connected with obligation (legal obligation) for damage or injury triggered to a 3rd party. Insurance coverage is a contract (policy) in which an insurer compensates an additional against losses from specific backups or hazards. There are several sorts of insurance policies. Life, health and wellness, home owners, and vehicle are among the most typical forms of insurance policy.

Investopedia/ Daniel Fishel Many insurance policy types are readily available, and basically any private or organization can find an insurance policy company eager to insure themfor a rate. Most people in the United States have at the very least one of these kinds of insurance, and cars and truck insurance policy is called for by state law.

Rumored Buzz on Pacific Prime

So locating the price that is ideal for you calls for some legwork. The policy restriction is the maximum amount an insurer will certainly spend for a covered loss under a policy. Optimums may be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, also referred to as the lifetime optimum.

Plans with high deductibles are usually less costly due to the fact that the high out-of-pocket expense normally causes fewer small cases. There are several kinds of insurance coverage. Let's take a look at one of the most essential. Health insurance policy assists covers routine and emergency situation medical care prices, often with the choice to add vision and oral solutions individually.

Lots of preventive services might be covered for complimentary before these are satisfied. Health insurance may be bought from an insurance provider, an insurance policy representative, the federal Medical insurance Marketplace, provided by a company, or government Medicare and Medicaid insurance coverage. The federal government no more requires Americans to have medical insurance, but in some states, such as California, you might pay a tax obligation penalty if you do not have insurance coverage.

Pacific Prime Things To Know Before You Buy

As opposed to paying out of pocket for automobile mishaps and damage, people pay yearly costs to an automobile insurer. The company then pays all or the majority of the covered prices connected with an auto crash or various other automobile damages. If you have a leased lorry or borrowed money to buy an auto, your lending institution or renting dealership will likely require you to bring car insurance coverage.

A life insurance plan warranties that the insurance company pays a sum of cash to your recipients (such as a spouse or youngsters) if you pass away. There are 2 primary kinds of life insurance.

Long-term life insurance policy covers your whole life as long as you proceed paying the costs. Traveling insurance covers the prices and losses related to taking a trip, including trip cancellations or delays, coverage for emergency situation healthcare, injuries and evacuations, harmed baggage, rental automobiles, and rental homes. Also some of the ideal travel insurance coverage firms do not cover terminations or delays because of weather, terrorism, or a pandemic. Insurance is a method to manage your monetary threats. When you buy insurance, you acquire defense against unanticipated monetary losses. The insurance provider pays you or a person you pick if something negative occurs. If you have no insurance policy and an accident occurs, you might be accountable for all associated costs.

A Biased View of Pacific Prime

Although there are lots of insurance policy types, several of one of the most common are life, wellness, home owners, and car. The right kind of insurance for you will rely on your objectives and financial situation.

Have you ever before had a moment while looking at your insurance coverage plan or buying for insurance coverage when you've assumed, "What is insurance? Insurance coverage can be a strange and confusing thing. Just how does insurance coverage work?

Nobody wants something negative to occur to them. Suffering a loss without insurance coverage can place you in a difficult financial circumstance. Insurance coverage is an essential monetary device. It can help you live life with fewer worries recognizing you'll obtain economic aid after a disaster or crash, helping you recuperate faster.

Pacific Prime - An Overview

And sometimes, like automobile insurance policy and employees' payment, you might be required by legislation to have insurance in order to safeguard others - international health insurance. Find out about ourInsurance alternatives Insurance is essentially an enormous wet day fund shared by lots of people (called policyholders) and taken care of by an insurance coverage you can look here copyright. The insurance coverage firm uses money collected (called premium) from its insurance holders and various other investments to spend for its operations and to satisfy its guarantee to insurance policy holders when they sue

Report this page